At this point, the possibility of criminal penalties is assessed to be low.

Cha Eun-woo apologized on social media and pledged to engage sincerely in future tax procedures.

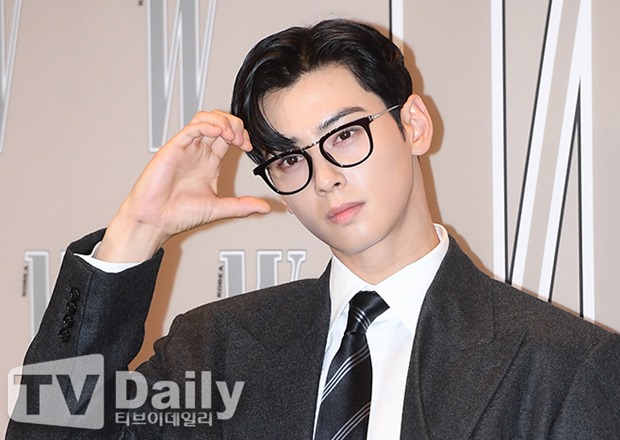

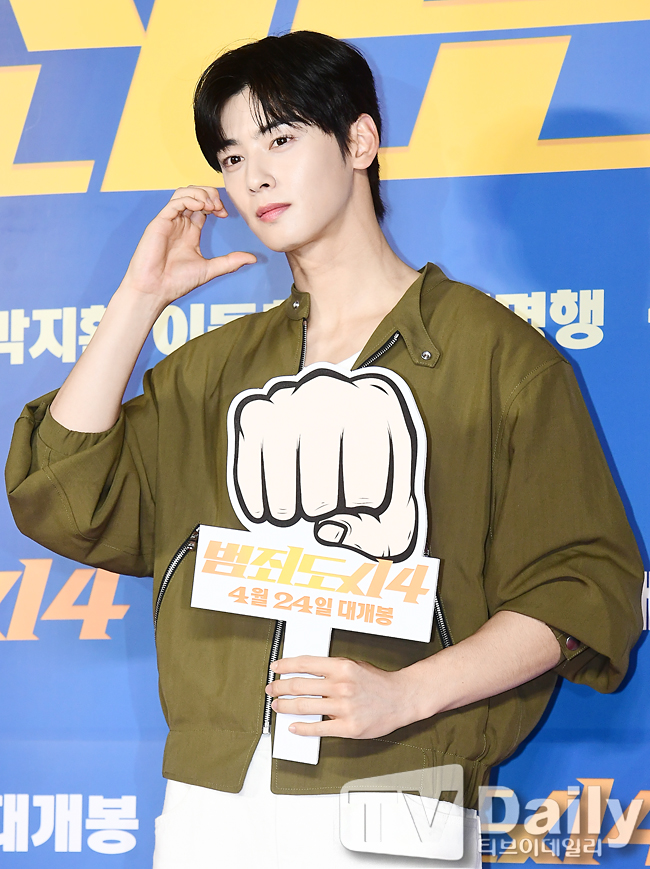

[TV Daily Reporter Kim Han-gil] Cha Eun-woo, a member of the boy group ASTRO and an actor, is currently facing tax evasion allegations amounting to 20 billion won. Tax expert Lim Soo-jung, a former National Tax Service official, stated that 'the likelihood of criminal penalties at this stage appears low.'

On January 27th's broadcast of CBS Radio's 'Park Sung-tae's News Show,' Lim discussed the core issues surrounding the case, particularly focusing on A Corporation, established by Cha Eun-woo's mother. He pointed out that there are suspicions that some of the income paid to Cha Eun-woo by his agency, Fantagio, was diverted to A Corporation in an attempt to mitigate taxes. This structure raised concerns regarding the lack of substantive profit generated by the corporation.

Lim also questioned the legitimacy of A Corporation's address, located at an eel restaurant in Incheon, stating that 'it is rare for a legitimate business to operate under such premises.' He further noted that determining intent in cases of tax evasion is critical, as large amounts of tax charges do not necessarily indicate intentional wrongdoing. Cha Eun-woo has since expressed remorse on social media, stating he will engage sincerely in the ongoing tax-related procedures.

This incident raises several legal issues concerning Cha Eun-woo's activities in the entertainment industry. The tax collection structure through corporations is one of the common methods utilized by celebrities, but the existence of a legitimate business entity remains crucial. Tax expert Lim Soo-jung emphasized the necessity to determine whether A Corporation is merely a paper company or a legitimate business; if it’s the latter, it could be recognized as a lawful business activity.

Celebrities generally earn high incomes, which can lead to a range of tax-related issues. In the case of Cha Eun-woo, being classified as a high-income self-employed individual means he may be subjected to more frequent scrutiny by the National Tax Service. The complexity of this case also lies in the fact that Cha Eun-woo's financial structure differs from that of typical entertainment professionals. Although tax evasion charges have been leveled, if the income distribution structure is not legally problematic, the outcome could favor Cha Eun-woo.

Finally, Cha Eun-woo's public apology ties into his image as a public figure. The relationship between celebrities and the media is extremely important; preemptively clarifying his position may contribute positively to restoring his public image. His commitment to engage sincerely in future tax procedures suggests that his handling of the situation could potentially have a positive impact on the unfolding of the case.

This article is KOSTAR’s reinterpretation of a story originally reported by TVDaily.

Photo: DB