He has been accused of tax evasion while sharing profits with a corporation founded by his mother.

This incident highlights economic polarization in the entertainment industry.

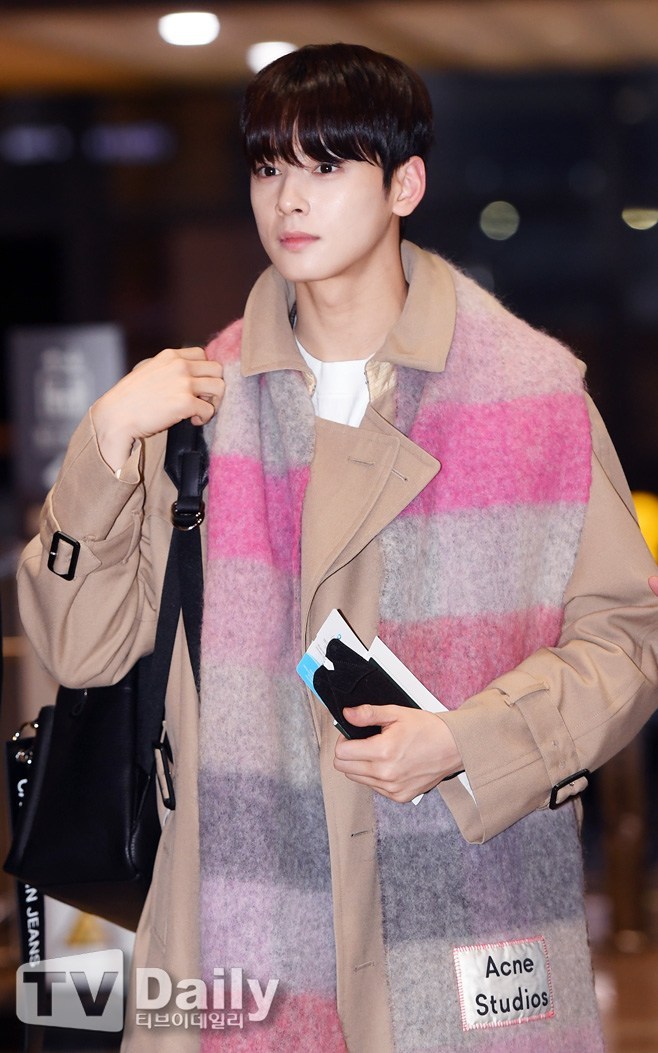

Cha Eun-woo (28) has found himself embroiled in controversy over a failure to pay 20 billion won in taxes. His agency, Fantagio, has reportedly entered into a contract with a corporation founded by his mother, sharing profits from his work. Currently, Cha's team has filed an objection to assess the appropriateness of the tax claim made by the National Tax Service. This situation is also interpreted as a metaphor for 'economic polarization'. The key issue at hand is whether the corporation established by Cha Eun-woo is a paper company. Furthermore, the past address of this corporation is linked to an eel restaurant that he reportedly frequented, adding to the scandal.

The Cha Eun-woo controversy prompts a closer examination of economic disparity within the entertainment industry. His situation reflects not just an individual income issue but also a broader strategy that exploits systematic loopholes in tax regulations. This case exemplifies the growing polarization in society and highlights how the efforts of high-profile celebrities to minimize their tax burdens can impose suffering on the general public.

Furthermore, the attempt by high-earning stars like Cha Eun-woo to reduce their taxes through corporate structures can lead to perceptions of illegality, impacting their financial status and public image. Other celebrities should take note of the potential risks associated with such strategies and the scrutiny that comes with them.

As discussions around the importance of taxation continue, the issues regarding severe tax evasion have put greater emphasis on improving social safety nets and addressing the unfair systems in place. Cha Eun-woo's case can be analyzed as a reminder of economic principles that are relevant to everyone, extending beyond the scope of just one celebrity's predicament.

This article is KOSTAR’s reinterpretation of a story originally reported by TVDaily.

Photo: TVDaily